If you’re diving into Solana token launches, you’ve probably heard the horror stories about rug pulls. Getting rugged can be brutal, but it’s avoidable if you know what to look for.

In this guide, we’ll walk you through practical steps to vet a project before investing your hard-earned SOL. From community vibes to team transparency, here’s how you can safeguard yourself against scams, all while making the most out of Solana token launchpad lists.

Where to Find Solana Token Launchpad Lists

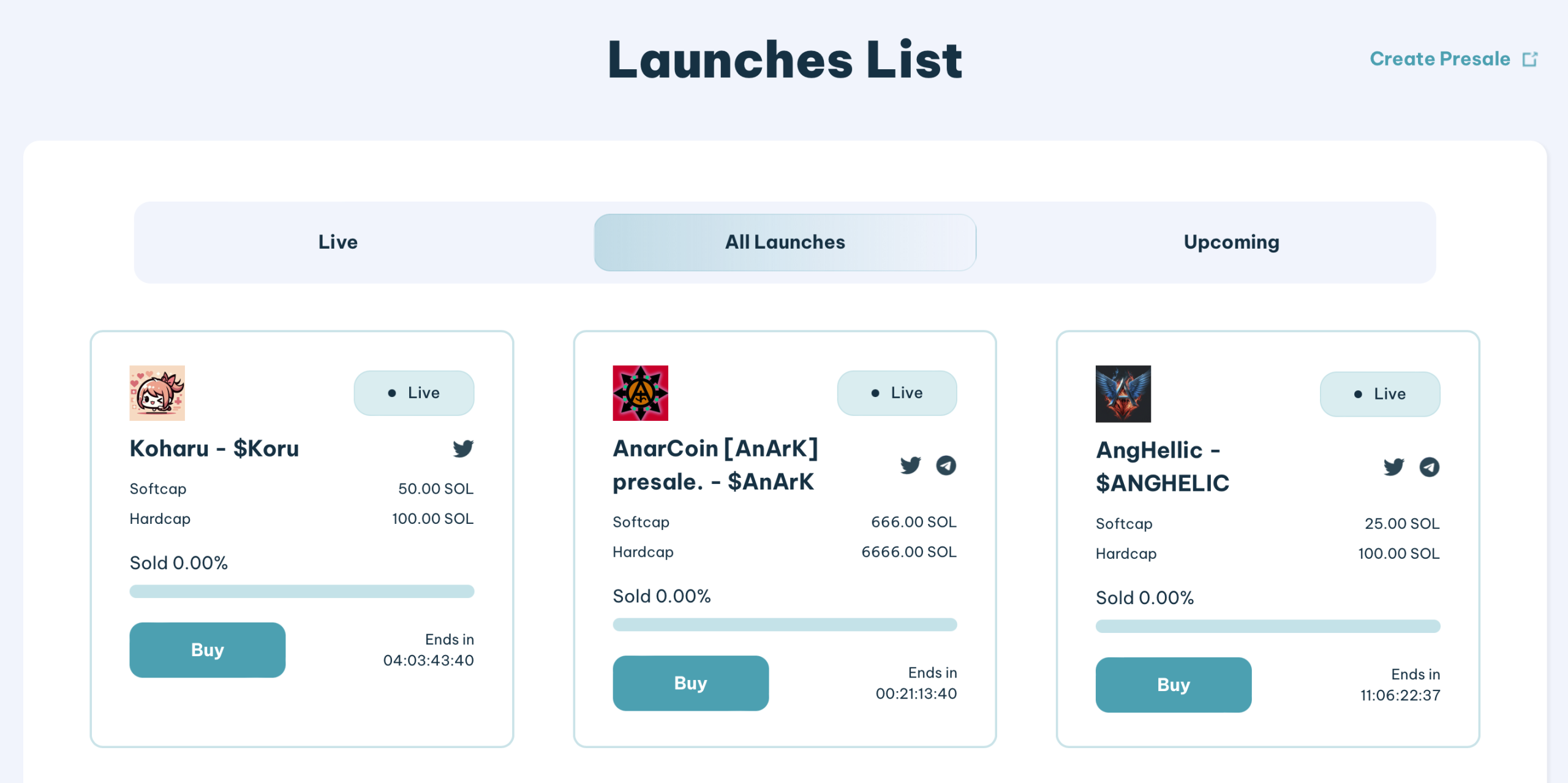

Before we jump into how to avoid getting rugged, you need to know where to find legitimate projects. Solana token launchpad lists are your go-to resources for discovering new opportunities in the Solana ecosystem. One reliable source is Smithii’s Launches List, where you can find a curated selection of ongoing and upcoming token launches.

These launchpad lists provide you with essential details like the project’s softcap, hardcap, and how much has been sold so far. This information is crucial in helping you gauge the level of interest and potential success of a project. But remember, just because a project is listed doesn’t mean it’s safe—this is where your due diligence comes into play.

1. Research the Team: Transparency Is Non-Negotiable

Doxxed Teams vs. Anonymous Ghosts

A doxxed team is your first line of defense against a rug pull. When team members are public about who they are, they have reputations to protect. This accountability reduces the chances of them disappearing with your funds. Check out their LinkedIn profiles, past projects, and see if they have a track record of delivering successful products.

Red Flags to Watch For:

- New Social Media Accounts: If the project’s Twitter or LinkedIn profiles were created last month, you should be skeptical. Established teams will typically have a more substantial online presence.

- Sketchy Roadmaps: If the project roadmap is full of buzzwords but lacks concrete milestones, they might be selling you dreams.

Why Team Background Matters

Before jumping in, dig into the team’s background. If the devs have worked on successful projects in the past, that’s a good sign. On the flip side, if they’re serial launchers of projects that die quickly, consider that a massive red flag. A quick Google search or even asking around in crypto forums can reveal a lot.

2. Assess the Community: It’s More Than Just Numbers

The Power of Community Engagement

A strong, active community can be the heartbeat of a project. Dive into the project’s Discord or Telegram groups. Are people asking smart questions? Are the devs responsive and transparent? Or is the conversation dominated by “when moon?” and mindless hype?

Avoiding Echo Chambers:

- Diverse Opinions: A good community welcomes diverse opinions and healthy skepticism. If the vibe is too uniform, with everyone mindlessly praising the project, that’s a red flag.

- Activity Level: A project with 10,000 members but only a handful chatting daily might have bought fake followers to appear legit.

Check Out Twitter and Reddit

The broader crypto community on Twitter and Reddit can provide unfiltered takes on a project. If you’re seeing a lot of bots pumping a token or questionable giveaways, that’s your cue to dig deeper.

3. Scrutinize the Tokenomics: The Devil’s in the Details

Fair Distribution Is Key

One of the easiest ways to spot a potential rug pull is by analyzing the tokenomics. How are the tokens being distributed? If a significant portion is allocated to the team or early investors without a vesting period, it could be a ticking time bomb waiting to go off.

Hardcap vs. Softcap:

- Understand the Funding Goals: A softcap is the minimum amount of funds needed for the project to proceed, while the hardcap is the maximum. Projects with ridiculously high hardcaps relative to their softcap may be more interested in a cash grab than in sustainable growth.

The Importance of Vesting Schedules

Vesting schedules prevent team members from dumping their tokens all at once, which can tank the token’s value. A fair vesting period aligns the team’s incentives with the long-term success of the project.

4. Seek External Validation: Don’t Just Take Their Word for It

Partnerships and Audits

Legit projects often have partnerships with well-known entities or have been audited by reputable firms. No audit? No partnership? That doesn’t automatically mean the project is a scam, but it should push you to do extra homework.

Look for Verified Partnerships:

- Don’t Be Fooled by Logos: Just because a project slaps a well-known logo on their website doesn’t mean they’re officially partnered. Double-check these claims through official announcements or reach out to the supposed partner for confirmation.

Audit Reports

An audit by a reputable firm like CertiK or Trail of Bits can give you peace of mind. These audits review the project’s codebase for vulnerabilities, reducing the risk of exploits post-launch. If a project skips this step, ask yourself why.

5. Trust Your Instincts and Use Common Sense

Hype vs. Reality: Keep Your Cool

If a project is making outrageous promises—like 100x returns in a month—it’s likely too good to be true. The fear of missing out (FOMO) can cloud your judgment, so take a step back and critically assess the project.

Final Gut Check:

- Does Everything Add Up?: After going through all the checks, if something still feels off, trust your gut. It’s better to miss out on a potential win than to fall into a scam.

Conclusion: Rug Pulls Are Avoidable—If You’re Careful

In the fast-paced world of crypto, due diligence is your best friend. By researching the team, engaging with the community, scrutinizing the tokenomics, seeking external validation, and trusting your instincts, you can significantly reduce your risk of getting rugged.

Solana token launchpad lists like Smithii’s Launches List are an excellent starting point, but it’s up to you to do the heavy lifting. Stay informed, stay vigilant, and happy investing!